Identify the Inventory Costing Method Best Described

Yields the highest net income. First in first out method.

Inventory Costing Methods Principlesofaccounting Com

Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements.

. Results in the highest cost of goods sold. The value of the inventory at the end of the period is 25000. A method of inventory costing that assumes the oldest merchandise is sold first.

Yields the highest net income. Has the lowest tax expense because of reporting the lowest net income. Identify the inventory costing method best described by each of the.

Tonds to sooth out the rate changes in costa 4. Assume a period of increasing costs. Yields the highest net income.

Has the lowest tax expense because of reporting the lowest net income. The inventory cost for that period is 50000 15000 25000 40000. Puts older costs on the balance sheet 2.

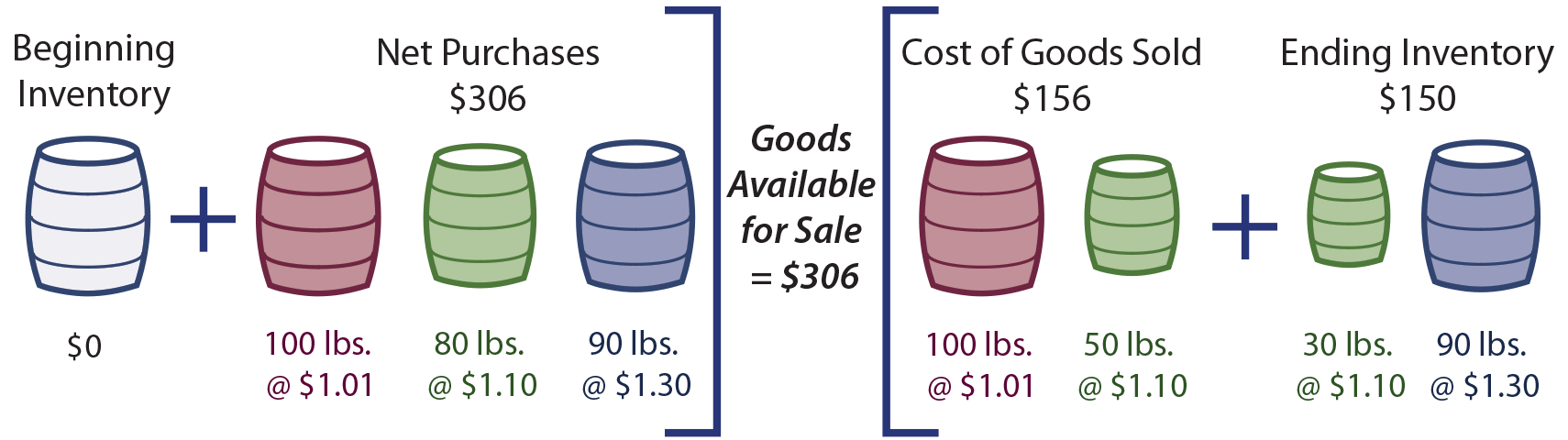

The oldest units are still in stock. Results in the highest cost of goods sold. Mueller Hardware paid 306 for 270 pounds producing an average cost of 113333 per pound 306270.

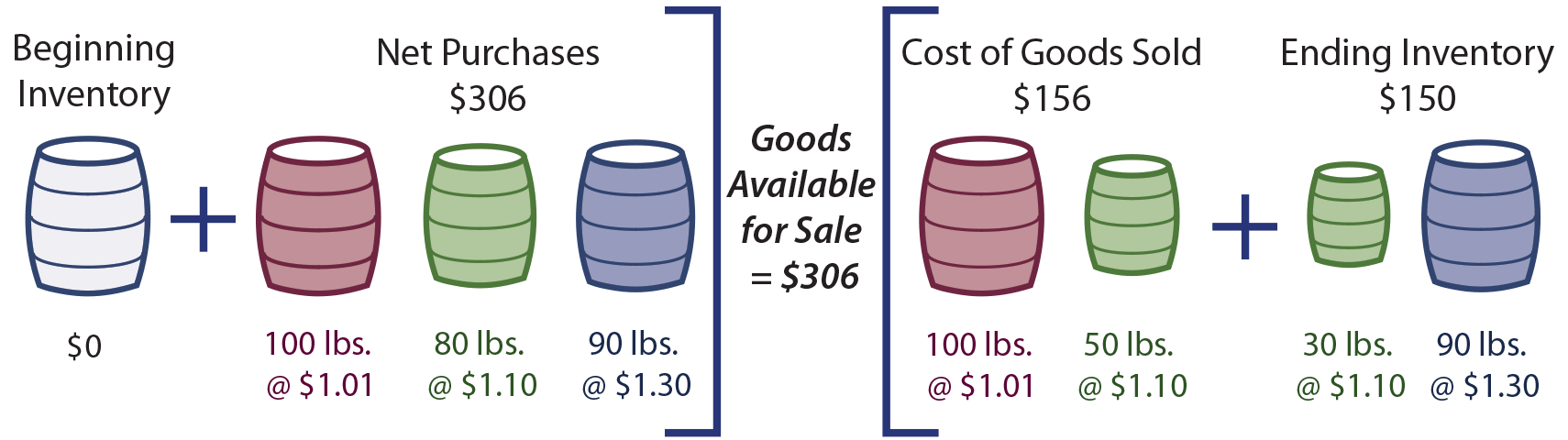

Identifying income tax effect of FIFO vs. This results in a cost-to-retail ratio or cost ratio of 80. Company must perform strictly proper accounting only for items that are significant to the businesss financial situation.

Identify the inventory costing method best described by each of the following separate statements. Results in the highest cost of goods sold. Identify the inventory costing method best described by each of the following separate statements.

Has the lowest tax expense because of reporting the lowest net income. Assume a period of increasing costs 181 DO 3092016 Has the lowest tax expense because of reporting the lowest net income 2. Yields a balance sheet inventory amount often markedly less than its replacement cost.

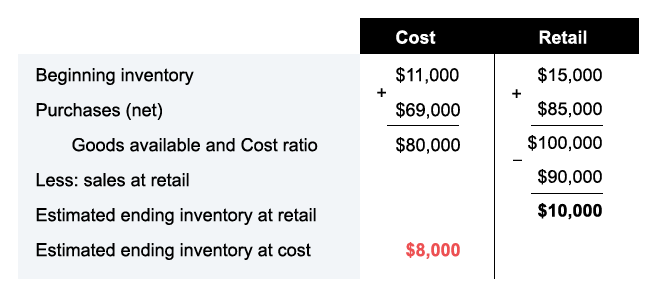

Assume a period of increasing costs. Average cost is determined by dividing total cost of goods available for sale by total units available for sale. Assume a period of increasing costs.

Assume a period of increasing costs. Here is the retail method formula courtesy of AccountingCoach. Identify the inventory costing method best described by each of the following separate statements.

A method of inventory costing using the average cost of units of an item available for sale during the period to arrive at cost of the ending inventory. Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements. Identify the inventory costing method best described by each of the following separate statements.

Better matches current costs with revenues. Identify which of the following items are not included as part of general-purpose financial statements but are part of financial reporting. Assume a period of increasing costs.

Precisely matches the costs of items with the revenues they generate. Retail inventory method formula. Better matches current costs with revenues e.

Example of the retail inventory method. 1 1 Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements. The specific identification method requires being able to follow a particular product exactly through its time with your business by using serial numbers or otherwise tagging the item.

Record keeping is more complex 3. Precisely matches the costs of items with the revenues they generate. Assume a period of increasing costs.

Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements. Specific Identification method of valuing the inventory states that the goods which have been sold out have been specifically identified from the particular lot of goods received and therefore the cost of that particular lot shall be applied on units sold to. Assumes the oldest units are sold first.

Assume a period of increasing costs. Assumes the newest units are sold first. When using this method you attach the exact cost of creating an item to that same item.

The ending inventory consisted of 120 pounds or 136 120 X 113333 average price per pound. Results in the highest cost of goods sold. Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements.

Approximates the flow of inventory costs in a business that is used to determine COGS and ending MI. Does not conform to the physical flow of goods 4. Results in the highest cost of goods sold.

Last in first out method. Assume a period of increasing costs. Assume a period of increasing costs.

The specific identification method is perhaps the most straightforward way to calculate inventory costs. Results in a balance sheet inventory amount approximating replacement cost. Vields the ghost gross profil 3.

This basic formula takes into account all the inventoriable costs required to get and keep. Identify the inventory costing method best described by each of the following separate statements. The preferred method when each unit of product has unique features that markedly affect cost.

Assume a period of increasing costs. Identify the inventory costing method best described by each of the following separate statements. Provides a tax advantage deferral to a corporation when costs are rising.

As AccountingCoach explains in the above example the cost of goods available of 80000 is divided by the retail amount of goods available 100000. Yields the highest net income. Assume a period of increasing costs.

Matches recent costs against net sales. AManagement letter to shareholders Yes. Identify the inventory costing method SI FIFO LIFO or WA best described by each of the following separate statements.

Answer is complete and correct. The newest units are still in stock. Identify the inventory costing method best described by each of the following separate statements.

Yields the highest net income. Results in the highest cost of goods sold. Yields the highest net income.

Reports a higher cost of goods sold. Tends to smooth out the erratic changes in costs. View Homework Help - chapter 5 hw answersdocx from ACC 101 at Nassau Community College.

5 Inventory Costing Methods For Effective Stock Valuation Lightspeed

Specific Identification Method Explanation Example Advantages And Disadvantages Accounting For Management

5 Inventory Costing Methods For Effective Stock Valuation Lightspeed

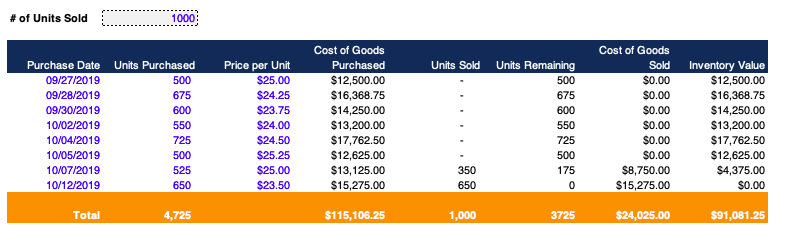

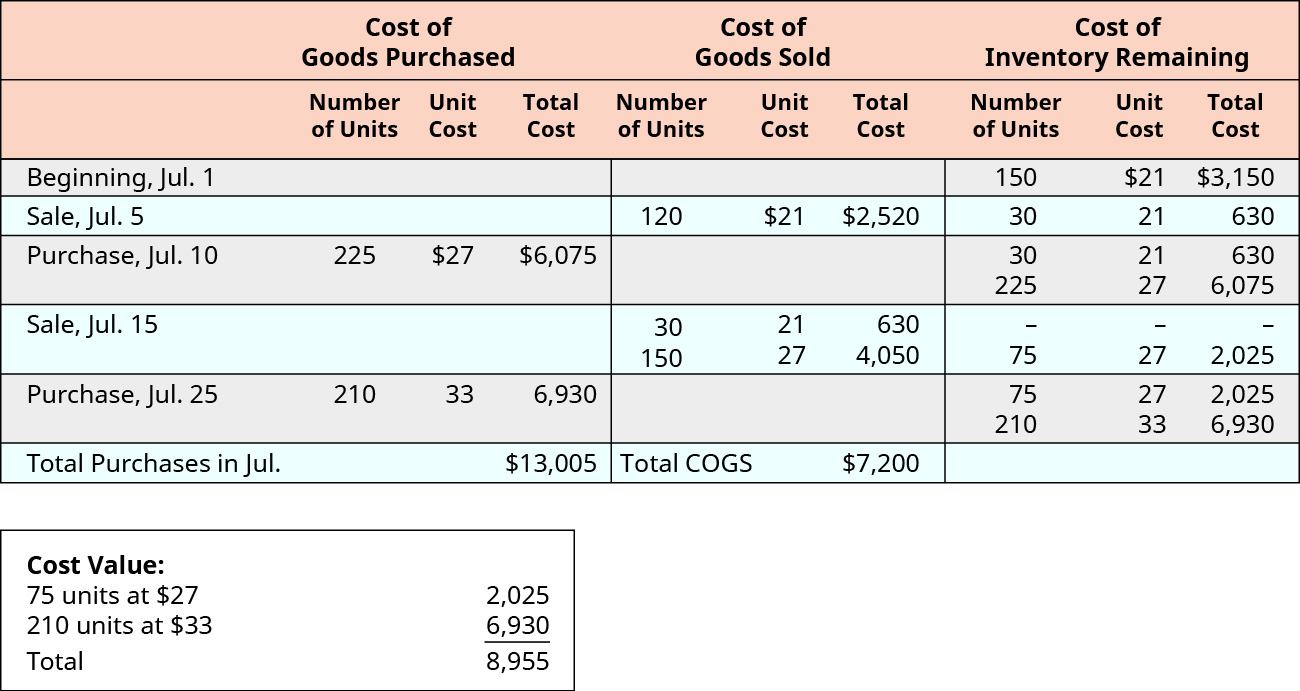

Calculate The Cost Of Goods Sold And Ending Inventory Using The Perpetual Method Principles Of Accounting Volume 1 Financial Accounting

0 Response to "Identify the Inventory Costing Method Best Described"

Post a Comment